David Zimmermann, PhD

Data Scientist

whoami

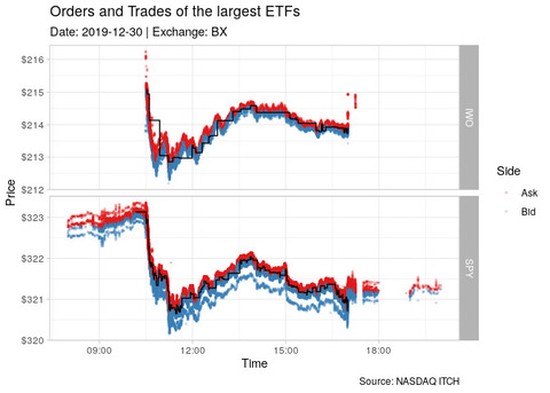

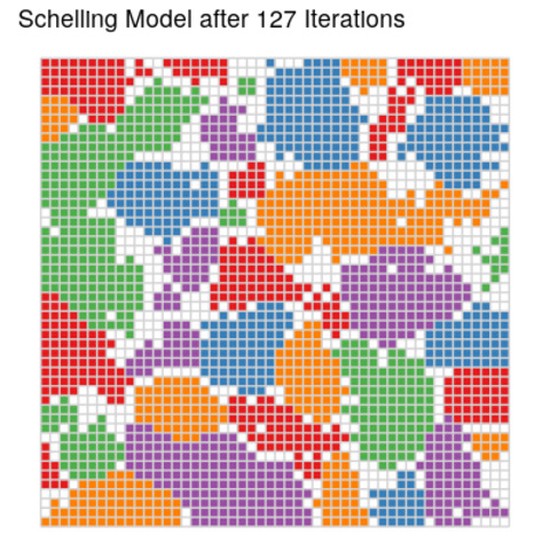

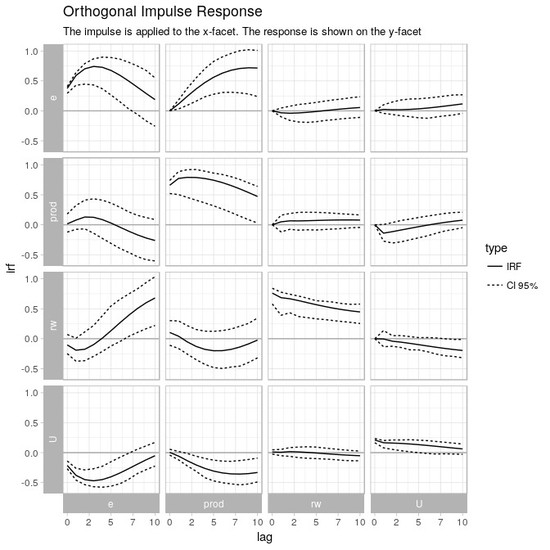

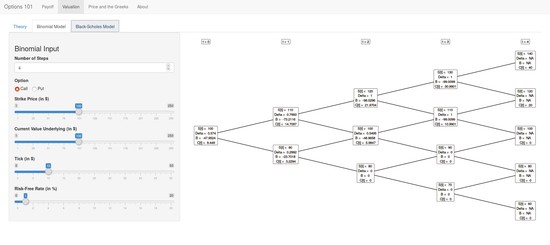

I am David Zimmermann, a data scientist from Cologne, Germany interested in solving real-world problems using machine learning, data science, and other appropriate measures. In my past, I did a PhD in computational finance, where I simulated financial markets using agent-based models to find the effects of high-frequency trading.

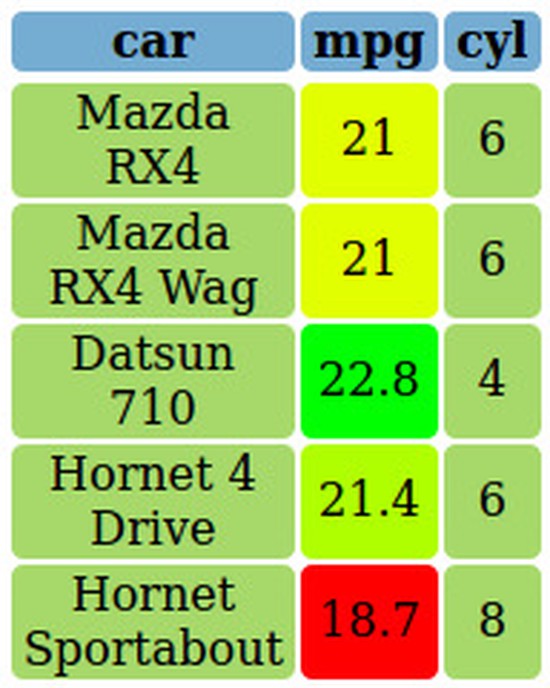

This blog was built with the intention to share different applications, tricks, and also some mild shenanigans with data, R, C++, Python, or other areas. If you have any comments, ideas, issues, or just want to give me a thumbs up, leave a note or write an email to david_j_zimmermann {at] hotmail [dot} com.

The source of this blog can be found on my .

Interests

- Data Science

- Machine Learning

- Programming

Education

-

PhD in Computational Finance, 2019

Universität Witten/Herdecke, Germany

-

MSc Finance & Investment, 2015

University of Edinburgh, UK

-

BA in Corporate Management & Economics (minor in Public Administration and International Relations), 2014

Zeppelin Universität, Germany